KYC stands for “Know Your Customer.” It is a process implemented by businesses and financial institutions to verify and authenticate the identity of their customers. KYC aims to prevent fraud, money laundering, and other illicit activities by ensuring businesses have accurate information about the individuals or entities they engage with, including their identity, financial transactions, and risk profile.

Putting an end to preconceived ideas

In recent years, companies and financial institutions have adopted KYC to verify and authenticate the identity of their customers. KYC involves implementing identity verification checks when a business relationship is entered into and regularly updating the information gathered.

Child’s play? Not necessarily. After all, companies must deal with an ever-increasing number of credentials, more demanding customers, and ever-greater fraud attempts. All these factors are making controls more complex by the day.

Are regulations a brake on growth?

European KYC compliance directives and customer due diligence requirements continue to evolve. It is not just regulatory pressure that makes these requirements increasingly more challenging to meet. The explosion in implementation and maintenance costs and the need to improve the customer experience are just as instrumental in making KYC a hot topic for companies. So it’s easy to understand why they are reluctant to meet their obligations…

And yet! Regulations are not a brake or a constraint for companies. They help establish a framework and the game’s rules to protect their customers and business. A solid, automated KYC process allows companies to know and understand their customers better. The result? Better risk management and more efficient customer service. If well integrated, a KYC process will not slow down growth – quite the opposite.

An additional step to ensure an optimal user experience

This additional step can be experienced as a constraint. To avoid this, the customer must take this step. The identity check should enable them to secure their journey by ensuring that they are the originator of the request. To achieve this, the company the customer wishes to enter into a contract will do everything possible to combat fraud and identity theft.

Their experience will be all the better for it!

Sometimes, users even prefer paths with a bit of friction to others that are too fast and fluid. Take, for example, a visual scanning tool that works so well that users doubt its reliability. To prevent them from giving up on the proposed service, UX designers will undoubtedly suggest adding an artificial waiting time to prevent doubt from taking hold. Friction is not only irritating; it can also be reassuring. The challenge is to find the right balance.

An opportunity, yes, but only tomorrow

Another common misconception? Digital identity is not for tomorrow or even the day after tomorrow. Companies think they have time before they have to tackle the problem head-on.

Time is running out. The eIDAS 2.0 regulation is about to come into force. All European Union member states will have to offer their citizens the option of having a digital wallet containing all their identity documents, the EU Digital Identity Wallet (EUDIW). It may well be that digital identity will become the norm for authentication and identification in the coming years. Why delay implementing a KYC process in your organization?

In concrete terms, eIDAS 2.0 will:

- create a digital identity portfolio for all residents of the European Union ;

- enable access to public and private services throughout the EU via a single digital identity;

- confirm the importance of KYC in verifying and guaranteeing the authenticity of electronic identities;

- strengthen security requirements for digital trust players;

- improve the security of electronic exchanges.

False good ideas

Too many companies try to do without automated KYC processes… at the risk of being penalized; we can’t stress this enough but KYC remains a legal obligation, not just for the finance and insurance sectors. Real estate, cryptocurrency, and telecommunications are also concerned by this issue.

Moreover, all these sectors, energy, mobility, online gaming, and sports betting, are not immune to potential fraudsters.

In particular, these provisions have been reinforced in the 6th Anti Money Laundering Directive, which came into force in June 2021.

One pivotal element within the framework of the 6th Anti-Money Laundering Directive (6AMLD) involves standardizing the definition of money laundering offenses. The significance lies in harmonization, as it will eliminate discrepancies in interpretation among various Member States’ domestic legislations, thereby promoting a more consistent and unified approach in combating illicit activities.

Under the provisions of the 6AMLD, a set of 22 predicate offenses will be introduced including cybercrimes and environmental crimes. This addition signifies the European Union’s heightened awareness of internal issues and its proactive commitment to address emerging challenges.

Checking a person’s identity also helps prevent identity heft, attempts, whether through document or data theft. KYC is, therefore, a win-win process. Customers lose neither their identity nor their money. And companies don’t have to pay heavy fines.

Maximize Savings

Maximize Savings

Choosing to adopt or develop them in-house may initially involve an investment, but in the long run, it proves to be a cost-effective choice compared to not implementing them at all.

That’s why Noémie Boris, compliance lawyer at Be Ys, encourages companies to implement “KYC : is a major challenge for companies wishing to build customer loyalty and reduce costs. A user-friendly KYC solution enables users to complete their journey more quickly and with greater data reliability and allows for compliance with regulation”.

Opportunities to accelerate onboarding

Improving customer paths

All too often, companies rely on outdated or even manual processes for KYC. The consequence for users? Having to wait days or even weeks for their identities to be authenticated. This can discourage some, leading them to abandon their desire to subscribe to a particular service.

Effective KYC processes are seamlessly integrated into the customer journey enabling rather that hindering the customer experience.

To avoid such scenarios, there’s one solution: choose your KYC process with care. It should have four key features:

- a simple, accessible interface;

- real-time document capture;

- automatic extraction and smooth, reliable verification of information;

- real-time identity verification using selfie and video facial recognition tools.

Human processing ensures maximum reliability, which is only sometimes possible with automatic solutions, particularly for complex and sensitive documents. Some countries have taken steps to supplement video identification with analysis by agents. The guarantee of 100% qualified identity

Accelerate your digital transformation with total security.

Only automated verification can reduce the number of errors and friction for customers without increasing the size of teams or their working hours. Trust those whose job is to develop them, especially as these solutions require official certification, which can be time-consuming and costly to obtain.

So why not consider a KYC solution as an investment in accelerating your company’s digital transformation? Why not make it a competitive differentiator? It’s nothing new that users look with interest at players capable of innovating to meet their legal obligations and expectations.

Positioning yourself as a trusted party

In a competitive, fast-moving market and in the face of ever-changing expectations, there are fewer and fewer opportunities to build customer trust and add value to your service.

A fluid, instantaneous KYC process can multiply them by optimizing the onboarding process, winning new customers while securing your exchanges, which, in the eyes of your customers, will identify you, de facto, as one of the players they can trust. The key is to be aware and seize the opportunity to turn KYC into a business opportunity.

To go further

What does KYC compliance mean for businesses?

Being subject to the principle of compliance and good practice helps to demonstrate exemplary business ethics. From this perspective, KYC can become a real competitive advantage. What's more, automated KYC processes enable you to concentrate on your core business, gain operational efficiency, position yourself as a trusted player, and thus double your market share.

And to customers

For customers, KYC compliance meets the challenge of securing their online transactions. It also benefits them from simplified, smoother online transactions and a better customer experience. It protects both personal data and the customers themselves from any attempt at fraud or identity theft.

How do you turn KYC into a business opportunity?

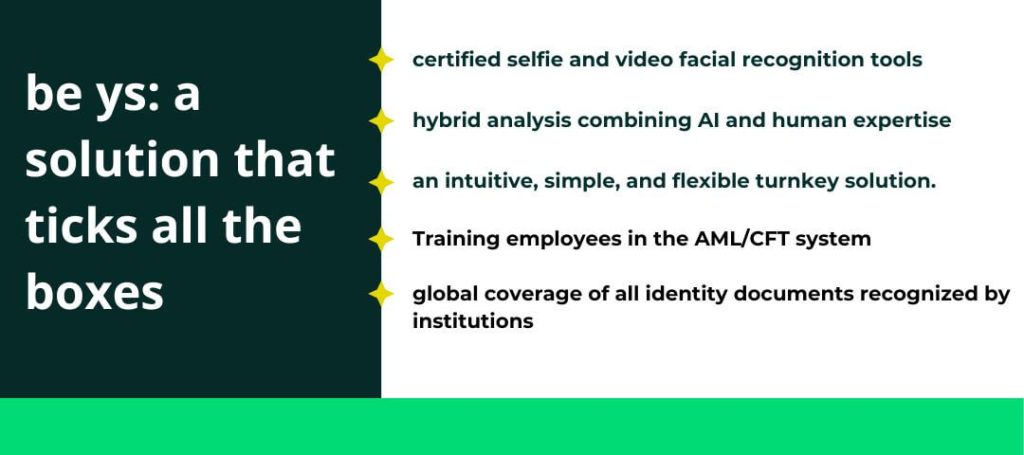

Using intelligent document processing and automation solutions that combine artificial intelligence and human expertise. This is the only way to ensure KYC compliance without compromising customer experience and operational performance.