Digital vault: your ally for data backup and confidentiality

Secondly, advancements in cryptography and encryption have made securing digital data feasible. Thirdly, the growth of cloud computing provided readily accessible and scalable infrastructure. Finally, increasing concerns about data breaches and identity theft fueled demand for robust protection measures. Together, these forces propelled the concept of a digital vault from dream to reality, offering a secure haven for our increasingly digital lives.

What is a digital vault?

A digital vault is a secure online storage system that protects sensitive data. It offers users a virtual space to store, organize, and manage digital information securely.

This computer storage system uses advanced encryption techniques to guarantee data security. The operation of a digital safe is based on robust security protocols. Data is encrypted when stored on the digital safe’s servers, making it inaccessible to unauthorized persons. In addition, access to data is protected by robust authentication mechanisms. Digital safes also offer automatic backup features, enabling users to back up their data regularly and reliably. This ensures data availability in the event of a disaster or accidental loss. Moreover, users can access their data anytime and anywhere, as long as they have an Internet connection.

Security of dematerialized data in a digital safe

The security of dematerialized data in a digital safe is a significant concern for users. Providers of these services invest in cutting-edge technologies to guarantee data security and protection. Data encryption is a primary means to ensure information security is stored in a digital safe. Data is converted into an unreadable format using advanced encryption algorithms, guaranteeing confidentiality and preventing unauthorized use. Robust authentication mechanisms, such as secure IDs and passwords, complete the package, and additional verification techniques, such as two-factor authentication, ensure that only authorized persons can access the data.

Regular data backup is also an essential component of dematerialized data security. Digital safe providers make regular backups of stored data to prevent any potential loss or damage.

This ensures that important information is always available, even in an incident. Finally, the physical security of the servers hosting the data is a significant concern for digital safety providers.

They use secure data centers with monitoring systems and access controls to protect the servers from unauthorized access. In conclusion, the security of dematerialized data in a digital safe relies on advanced protection measures, such as data encryption, secure authentication, and regular backup. Users can be confident that their confidential and sensitive information is safe when stored in a digital safe.

What are the advantages of a digital vault?

Protecting and safeguarding sensitive data

Security and protection of sensitive data are essential to any business. Using a digital vault offers numerous advantages in storing, encrypting, and safeguarding sensitive data. First and foremost, a digital safe provides secure storage for sensitive company data. Thanks to advanced IT security measures, confidential information such as contracts, financial data, and customers’ personal details are protected from unauthorized access. Data encryption ensures only authorized persons can access it, reinforcing confidentiality and information protection. In addition, the digital safe offers automatic, regular backup of sensitive data. This prevents data loss in the event of disaster or hardware failure. Data is stored securely in the digital environment, providing a reliable solution that can be accessed anytime. If necessary, backed-up data can be quickly retrieved, facilitating business continuity and efficient management of sensitive information.

Finally, the digital safe guarantees the confidentiality of stored information. Thanks to advanced security measures, only authorized persons can access sensitive data. Access authorizations can be precisely defined, controlling who can view or modify information. This feature enhances data security and prevents the risk of unauthorized disclosure.

Confidentiality and information security

Confidentiality and security of information are crucial for companies. Using a digital safe offers a reliable solution for guaranteeing confidentiality, security, and efficient management of confidential information. Regarding privacy, the digital safe uses advanced encryption mechanisms to protect sensitive data. Information is converted into a format unreadable by any unauthorized person, ensuring that only those with the appropriate access rights can view it. Additionally, activity-tracking functionalities keep track of all actions performed on data, offering greater transparency and accountability. In terms of security, the digital safe uses robust protection measures to prevent attacks and intrusions. The servers on which sensitive data is hosted are highly secure, with firewalls and advanced intrusion detection systems.

What’s more, regular backups ensure that data is protected against loss caused by incidents such as hardware failure or natural disasters. In conclusion, a digital vault offers numerous advantages regarding security, protection, storage, and backup of sensitive data. Thanks to advanced encryption measures, confidentiality of information is guaranteed, while activity tracking features enhance security. As a result, companies can effectively manage their confidential information while complying with current regulations.

Saving time and space

It goes without saying that a digital safe saves space and, therefore, real estate costs. No more boxes piled up in an unsuitable room, where documents deteriorate over time. And with the increase in bad weather and flooding, your documents are also on the front line.

And what about a filing system that only a few insiders can understand? The digital safe integrates different filing rules to suit every company profile. A few clicks are all it takes to find a document.

Digital vault: how can they be used by professionals?

The digital safe offers many advantages for managers, employees, customers, and suppliers.

For managers

The digital safe simplifies relations with public authorities and partners. It makes it possible to quickly retrieve documents required for administrative procedures, such as calls for tender or audits. Moreover, this solution makes sharing documents with accountants, shareholders, and directors easy.

For employees

It offers secure access to their documents, such as pay slips, employment contracts, and health-related documents. It also enables employees to file documents with the company, such as vacation requests or expense claims.

For customers and suppliers

This type of solution simplifies document exchange. Customers can consult invoices and contracts, while suppliers can submit purchase orders or invoices.

So you see. The digital safe is an indispensable tool for companies of all sizes. It simplifies document management, boosts productivity, and improves data security.

How do you choose a digital safe?

To choose the right electronic safe for your needs, it’s essential to consider the following criteria:

- legal compliance: the electronic safe must comply with current local standards

- Interoperability: the electronic safe must be compatible with your payroll or human resources management software.

- Storage capacity: the electronic safe must have sufficient capacity to store the documents you wish to keep.

- Security: the electronic safe must guarantee the security of your data using strong encryption and authentication mechanisms.

- Accessibility: the electronic safe must be accessible to your teams and employees securely and without restrictions.

Here are some concrete examples of questions you can ask yourself to assess each of these criteria:

- Interoperability: Is it compatible with my payroll software? Is it compatible with my human resources management software?

- Storage capacity: How many documents do I want to store? What type of documents do I like to store?

- Security: Does the electronic safe use strong encryption? Does the electronic safe have a secure authentication system?

- Accessibility: Where is the digital safe solution hosted? What standards are applied (ISO 27001, HDS)? Is the digital safe accessible from a smartphone or tablet?

You can choose an electronic safe tailored to your needs and requirements by asking yourself these questions.

What is the legal value of an electronic signature?

In fact, the electronic signature makes it possible to eliminate printing, which is an important CSR initiative. From 2025 onwards, most European companies must commit to a CSR approach.

This article will examine the legal implications and the many possible uses. However, it is essential to remember that the electronic signature, like the handwritten one, represents consent and commitment from the person signing.

What is consent?

Consent is a strong act that commits the signatory in the context of an electronic signature. It must be expressed clearly, explicitly, freely, and informedly without constraint or pressure.

In a digital context, consent can take various forms, from a simple click on a box on a form to a qualified electronic signature. The choice of means of obtaining consent will depend essentially on the nature of the commitment.

How can an electronic signature have the same legal value as a handwritten signature?

For an electronic signature to have the same legal value as a handwritten signature, it must meet specific requirements. These requirements are defined by legislation.

What does the law say?

In France, the electronic signature was regulated by Law no. 2000-230 of March 13, 2000, adopted following the European Directive 1999. This law gave electronic signatures the same legal value as handwritten signatures, provided that the process was reliable.

An electronic signature is “a reliable identification process guaranteeing its link with the act to which it relates, and conferring on the latter the authenticity and, where applicable, the integrity of the data to which it refers.”

These articles stipulate that the electronic signature must be :

- Reliable, i.e., it must make it possible to identify the signatory and guarantee the integrity of the document signed;

- Durable, i.e., it must enable the link between the signature and the signed document to be maintained.

What about the eIDAS regulation?

Adopted on July 23, 2014, eIDAS (Electronic Identification And Trust Services) is a European regulation that applies to all EU member states. In this sense, eIDAS is a genuine legal innovation that aims to encourage the development of digital uses in Europe.

The eIDAS regulation has had a significant impact on electronic signatures in Europe. It has clarified and harmonized the rules applicable to electronic signatures, facilitating their deployment.

What are the 3 types of electronic signatures?

The eIDAS regulation distinguishes three types of electronic signatures: simple electronic signature, advanced electronic signature, and qualified electronic signature.

The reliability of an electronic signature is based on the signatory’s identification and the signed document’s integrity.

Uses of qualified electronic signatures

The qualified electronic signature is the most secure of all. It carries a presumption of reliability, thus reversing the burden of proof. Thus, in a dispute, the burden of proof is reversed: it is up to the person contesting its validity to prove that it is invalid. In short, qualified electronic signatures are presumed to be reliable. It, therefore, has the same value as a handwritten signature.

It is created using a QSCD (Qualified Signature Creation Device), such as a smart card or a server managed by a Qualified Trust Service Provider (QTSP). This is known as a remote QSCD.

The qualified electronic signature is based on a qualified electronic certificate delivered face-to-face or equivalent after checking the identity of its owner.

A qualified electronic signature is required for specific documents, such as authentic instruments or certain documents subject to administrative control. It is used for documents with high legal risk or regulated transactions.

The uses of advanced electronic signatures

An advanced electronic signature guarantees the authenticity and integrity of the signed document. It is created using a technical process that identifies the signatory and ensures that the document has not been altered.

To present proof of the advanced signature, it must be available, legible, and known by the signature user.

The advanced signature can be issued by a Certification Authority or a PSCQ (in the eIDAS sense).

The advanced signature is highly recommended for signing documents such as commercial contracts, credit agreements, or insurance policies requiring detailed identity verification. It guarantees the identity of the signatory. The integrity of the document is also guaranteed. In the event of a dispute, the burden of proving the authenticity of an advanced signature lies with the party wishing to assert its validity.

Uses of the simple electronic signature

The simple electronic signature is the most common type of electronic signature. However, its reliability and probative value depend on the evidence associated with it.

It is sufficient for documents with low legal or financial risks, such as purchase orders or general terms and conditions of use (GTCU).

It provides proof of the document’s integrity, even if the signatory’s electronic means of identification rely on a limited degree of reliability.

In conclusion

o be legally valid, signed documents must be protected. To avoid any dispute over proof of signature, it is therefore strongly recommended to rely on proven solutions developed by trusted service providers.

Advanced and qualified electronic signatures use a digital certificate associated with the signatory’s name and a secret key managed by be ys. The simple signature, on the other hand, is protected by a server seal affixed by be ys.

The choice of electronic signature level depends on the use and importance of the document to be signed. A high-level electronic signature will be more difficult to contest in a dispute.

Once the signing has been completed, the documents can be stored in a secure digital archive or safe to guarantee their integrity.

KYC and electronic signature: the winning bet for security

KYC (Know Your Customer) and electronic signatures are two essential security tools for companies wishing to protect their data and transactions. KYC makes it possible to identify and verify the identity of a customer or partner. It comes into play in the context of electronic signatures. In fact, they must ensure that the person signing is who they claim to be behind the screen.

There are two ways of verifying identity within the electronic signature:

- Level 1: sending identity documents (ID card or passport)

- Level 2: Level 1 + visual identification to ensure the signatory is alive and well. This identification can be done face-to-face or remotely via a PVID (Remote Identity Verification Provider).

A KYC process helps combat identity theft. Significantly, the cost of fraud weighs heavily on the global economy. A PwC study revealed that 47% of companies worldwide have been victims of fraud in the last two years. For example, the banking and insurance sector suffered an estimated 525 million euros in fraud in France in 2020.

The KYC process and electronic signature must be integrated into a fully digitized customer experience. The aim is to offer users a fluid, simple, and rapid experience.

How do we combat fraud effectively?

Fraud on the rise?

The widespread use of teleworking, the proliferation of online shopping, the rise of neobanks, and the advent of cryptocurrencies: in recent years, our working and consumer habits have changed dramatically… much to the delight of fraudsters! For them, the COVID-19 health crisis has multiplied the loopholes and, therefore, the opportunities: from distracted employees to weakened companies, they have taken advantage of the insecurity generated by the pandemic.

Because employees working outside the company’s secure networks were not the only targets of fraudsters, observers noted an increase in the theft of synthetic identities during the same period, i.e., identities created from a mixture of real and false personally identifiable information. Fraud is everywhere, sparing no one and no sector.

A business open 24 hours a day

This feeling is all the stronger as there seems to be no respite. Before the health crisis, attacks peaked at the beginning of the week, then declined until reaching their lowest levels at the weekend. Since then, the habits of fraudsters, like our own, have changed. Tuesday, Thursday, Saturday, …: weekdays are no longer necessary to them. They even operate at weekends, all day long, aided by the hyperconnectivity of our societies.

But fraudsters still need to adapt their opening hours. Their methods, too, have adjusted. Fraudsters now prefer quantity to quality, massive attacks on computer systems to targeted blows. The problem? This flood of less sophisticated attacks diverts attention from the rarer but more ingenious fraud. That’s why it’s so essential for companies to automate fraud detection. Otherwise, they risk needing to be sufficiently protected against large-scale and more sophisticated attacks.

Fact of the day: 46% of companies reported having been victims of fraud in the last 24 months.

Fraudsters are as inventive as ever.

This is all the more important as fraudsters are not lacking in imagination. Identity fraud is a case in point. Fraudsters could stick to creating hybrid identities. To do this, nothing could be “simpler”: take the elements of a genuine identity, such as name or social security number, and modify them enough to give the impression that it is indeed a real identity. The problem? Hybrid identity fraud is easy to spot. They’re even more accessible to spot when they contain a large amount of accurate data. This makes it easier to cross-check with the real identity.

Another type of identity theft is synthetic identity fraud. With these, detection by simple data cross-checking is more complex. Which doesn’t mean we have to give up! However, identity verification processes that meet the requirements of KYC regulations prevent them from falling through the cracks. How do they do this? By combining identity document verification and biometric testing.

The cost of fraud

Getting punished

Above all, they prevent companies and organizations from being penalized. In some sectors, KYC remains a legal obligation. This is particularly true of the financial, insurance, and mutual insurance sectors. European and national regulations oblige players in these sectors to check the identity of their customers and the traceability of their transactions. And if they fail to do so? The regulator is uncompromising. In 2022 alone, the sanctions committee of the French banking regulator, the Autorité de Contrôle Prudentiel et de Résolution (ACPR), fined financial institutions over 14 million euros for failing to meet their regulatory obligations. Of the 39 grievances, more than a third concerned the KYC process. The fines can be substantial. A major insurance company can testify to this. It was fined 3.5 million euros for shortcomings in the fight against money laundering and the financing of terrorism.

However, fraud and identity theft are not problems unique to the finance or insurance sectors. Real estate, cryptocurrencies, and telecommunications are also affected by this issue. Moreover, all these sectors, as well as energy, mobility, insurance, and online gaming, are not immune to potential fraudsters who would involve their customers in contentious actions.

Paying a high price

They are just as exposed to another type of penalty. Fraud costs companies dearly. According to the International Monetary Fund (IMF), the volume of money laundering worldwide is between 2% and 5% of the Gross Domestic Product (GDP), or around 233 billion euros. That’s twice the size of France’s budget… It’s easy to see why the fight against money laundering is essential to corporate strategy.

UK Finance, the trade association for the British banking and financial services sector, estimates that fraudsters will have embezzled more than 700 million euros in the first half of 2022 alone. As for identity theft, the figures are no more reassuring: synthetic identity fraud is estimated to have cost $20 billion! Therefore, not opting for a KYC process would be tantamount to exposing yourself to a double penalty – paying twice!

Tools to combat fraud effectively

Prevention rather than cure

However, solutions do exist to combat fraud effectively. The first line of defense? Onboarding, because this is where fraud detection must begin. For a potential customer, onboarding represents the first contact with a company. That’s why it’s essential to associate an identification interface with this stage and, if possible, one that’s as accessible.

Another tip: don’t rely on a single approach to detecting and preventing fraud. As we have seen, fraudsters redouble their ingenuity to circumvent defense systems and invent new means of action. Companies make themselves more vulnerable by relying on a single form of verification. Hence, it is essential to adopt a multi-layered approach to fraud detection.

Check who you’re dealing with

This is all the more true given that fraudsters now prefer quantity to quality. That’s why it’s so essential for companies to rely on a trusted third party to integrate an automated KYC process. Solutions such as those we offer enable the capture of identity documents in real-time. The benefits? There are many! These include direct analysis of document security features and automatic recognition of the type of document transmitted.

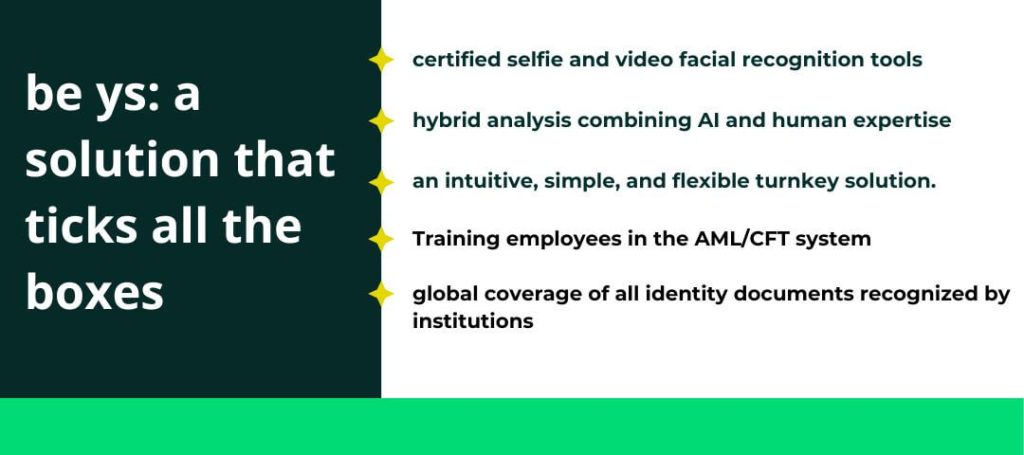

Once the information has been automatically extracted, it is checked for veracity and authenticity. At be ys, we do it twice! Our AI carries out an initial analysis in just a few seconds. If this analysis proves incomplete, our experts can take over to ensure all the guarantees of an effective fight against fraud and 100% identity recognition. We can guarantee this because we verify identity using facial recognition tools based on selfies and videos. And, I’m sure you’ll agree, it’s a real asset to verify in real-time that the person behind the screen is whom they claim to be! Particularly in a context of digitalization and the omnipresence of distance, such as the one in which we live and work.

To go further

How much does fraud cost companies?

n addition to the penalties they risk exposing themselves to by failing to implement KYC processes, companies pay a high price for fraud. Annually, an estimated 233 billion euros go up in smoke due to money laundering.

Which stage of the business relationship represents the most significant fraud risk for companies?

Which stage of the business relationship represents the most significant fraud risk for companies?

Without a doubt, onboarding!

How can we effectively combat fraud?

There's no single recipe for stopping fraud. But a well-deployed, automated identity verification process is a solid bulwark against fraud and identity theft for companies and customers.

The KYC challenges: turning constraints into opportunities

KYC stands for “Know Your Customer.” It is a process implemented by businesses and financial institutions to verify and authenticate the identity of their customers. KYC aims to prevent fraud, money laundering, and other illicit activities by ensuring businesses have accurate information about the individuals or entities they engage with, including their identity, financial transactions, and risk profile.

Putting an end to preconceived ideas

In recent years, companies and financial institutions have adopted KYC to verify and authenticate the identity of their customers. KYC involves implementing identity verification checks when a business relationship is entered into and regularly updating the information gathered.

Child’s play? Not necessarily. After all, companies must deal with an ever-increasing number of credentials, more demanding customers, and ever-greater fraud attempts. All these factors are making controls more complex by the day.

Are regulations a brake on growth?

European KYC compliance directives and customer due diligence requirements continue to evolve. It is not just regulatory pressure that makes these requirements increasingly more challenging to meet. The explosion in implementation and maintenance costs and the need to improve the customer experience are just as instrumental in making KYC a hot topic for companies. So it’s easy to understand why they are reluctant to meet their obligations…

And yet! Regulations are not a brake or a constraint for companies. They help establish a framework and the game’s rules to protect their customers and business. A solid, automated KYC process allows companies to know and understand their customers better. The result? Better risk management and more efficient customer service. If well integrated, a KYC process will not slow down growth – quite the opposite.

An additional step to ensure an optimal user experience

This additional step can be experienced as a constraint. To avoid this, the customer must take this step. The identity check should enable them to secure their journey by ensuring that they are the originator of the request. To achieve this, the company the customer wishes to enter into a contract will do everything possible to combat fraud and identity theft.

Their experience will be all the better for it!

Sometimes, users even prefer paths with a bit of friction to others that are too fast and fluid. Take, for example, a visual scanning tool that works so well that users doubt its reliability. To prevent them from giving up on the proposed service, UX designers will undoubtedly suggest adding an artificial waiting time to prevent doubt from taking hold. Friction is not only irritating; it can also be reassuring. The challenge is to find the right balance.

An opportunity, yes, but only tomorrow

Another common misconception? Digital identity is not for tomorrow or even the day after tomorrow. Companies think they have time before they have to tackle the problem head-on.

Time is running out. The eIDAS 2.0 regulation is about to come into force. All European Union member states will have to offer their citizens the option of having a digital wallet containing all their identity documents, the EU Digital Identity Wallet (EUDIW). It may well be that digital identity will become the norm for authentication and identification in the coming years. Why delay implementing a KYC process in your organization?

In concrete terms, eIDAS 2.0 will:

- create a digital identity portfolio for all residents of the European Union ;

- enable access to public and private services throughout the EU via a single digital identity;

- confirm the importance of KYC in verifying and guaranteeing the authenticity of electronic identities;

- strengthen security requirements for digital trust players;

- improve the security of electronic exchanges.

False good ideas

Too many companies try to do without automated KYC processes… at the risk of being penalized; we can’t stress this enough but KYC remains a legal obligation, not just for the finance and insurance sectors. Real estate, cryptocurrency, and telecommunications are also concerned by this issue.

Moreover, all these sectors, energy, mobility, online gaming, and sports betting, are not immune to potential fraudsters.

In particular, these provisions have been reinforced in the 6th Anti Money Laundering Directive, which came into force in June 2021.

One pivotal element within the framework of the 6th Anti-Money Laundering Directive (6AMLD) involves standardizing the definition of money laundering offenses. The significance lies in harmonization, as it will eliminate discrepancies in interpretation among various Member States’ domestic legislations, thereby promoting a more consistent and unified approach in combating illicit activities.

Under the provisions of the 6AMLD, a set of 22 predicate offenses will be introduced including cybercrimes and environmental crimes. This addition signifies the European Union’s heightened awareness of internal issues and its proactive commitment to address emerging challenges.

Checking a person’s identity also helps prevent identity heft, attempts, whether through document or data theft. KYC is, therefore, a win-win process. Customers lose neither their identity nor their money. And companies don’t have to pay heavy fines.

Maximize Savings

Maximize Savings

Choosing to adopt or develop them in-house may initially involve an investment, but in the long run, it proves to be a cost-effective choice compared to not implementing them at all.

That’s why Noémie Boris, compliance lawyer at Be Ys, encourages companies to implement “KYC : is a major challenge for companies wishing to build customer loyalty and reduce costs. A user-friendly KYC solution enables users to complete their journey more quickly and with greater data reliability and allows for compliance with regulation”.

Opportunities to accelerate onboarding

Improving customer paths

All too often, companies rely on outdated or even manual processes for KYC. The consequence for users? Having to wait days or even weeks for their identities to be authenticated. This can discourage some, leading them to abandon their desire to subscribe to a particular service.

Effective KYC processes are seamlessly integrated into the customer journey enabling rather that hindering the customer experience.

To avoid such scenarios, there’s one solution: choose your KYC process with care. It should have four key features:

- a simple, accessible interface;

- real-time document capture;

- automatic extraction and smooth, reliable verification of information;

- real-time identity verification using selfie and video facial recognition tools.

Human processing ensures maximum reliability, which is only sometimes possible with automatic solutions, particularly for complex and sensitive documents. Some countries have taken steps to supplement video identification with analysis by agents. The guarantee of 100% qualified identity

Accelerate your digital transformation with total security.

Only automated verification can reduce the number of errors and friction for customers without increasing the size of teams or their working hours. Trust those whose job is to develop them, especially as these solutions require official certification, which can be time-consuming and costly to obtain.

So why not consider a KYC solution as an investment in accelerating your company’s digital transformation? Why not make it a competitive differentiator? It’s nothing new that users look with interest at players capable of innovating to meet their legal obligations and expectations.

Positioning yourself as a trusted party

In a competitive, fast-moving market and in the face of ever-changing expectations, there are fewer and fewer opportunities to build customer trust and add value to your service.

A fluid, instantaneous KYC process can multiply them by optimizing the onboarding process, winning new customers while securing your exchanges, which, in the eyes of your customers, will identify you, de facto, as one of the players they can trust. The key is to be aware and seize the opportunity to turn KYC into a business opportunity.

To go further

What does KYC compliance mean for businesses?

Being subject to the principle of compliance and good practice helps to demonstrate exemplary business ethics. From this perspective, KYC can become a real competitive advantage. What's more, automated KYC processes enable you to concentrate on your core business, gain operational efficiency, position yourself as a trusted player, and thus double your market share.

And to customers

For customers, KYC compliance meets the challenge of securing their online transactions. It also benefits them from simplified, smoother online transactions and a better customer experience. It protects both personal data and the customers themselves from any attempt at fraud or identity theft.

How do you turn KYC into a business opportunity?

Using intelligent document processing and automation solutions that combine artificial intelligence and human expertise. This is the only way to ensure KYC compliance without compromising customer experience and operational performance.